Operating Units

In the financial applications of Oracle's E-Business Suite, an Operating Unit (OU) is a system organization that:

1. Stores subledger data separately from the data associated with other OUs that support a particular ledger ("Partitions").

2. Administers subledger rules such as those associated with transaction types, sequencing schemes, and other sales tax or VAT regulations ("Complies").

3. Administers user access to the data for processing and reporting ("Secures").

4. Applies to subledger business transaction and document data and associated data such as customer details. Subledger accounting data is not tagged with OU identification unless you elect to do so. General ledger data is not managed through

OUs.

5. Is not product specific and automatically links all subledger products that post to a specific ledger.

Multiple Organizations is the name we give to the functionality that surrounds OUs and it is exploited by all products as appropriate. System legal entities, Ledgers, and OUs are defined in relationship to one another. A legal entity accounts for itself in the Primary Ledger and optionally in other ledgers, and stores its subledger data in one or more OUs.

OUs are often identified with security. In the Oracle E-Business Suite, users are given access to the data they handle though "responsibilities". A responsibility is associated with a specific OU, or with several OUs - this is a feature called "Multiple Organizations Access Control". By securing subledger data in this way users can access and process transaction information only for the particular operating unit or set of operating units to which they have been granted access. They view only what they need and have authorization to view.

OUs can be used to model autonomous organizational units that create financial transactions. You create, process, and report on subledger financial data within the context of an OU.

- Use an OU when you need to keep the data of one organization distinct - at arms length - from the data of another organization. You might have the right to prevent a state's transaction tax auditor from viewing the transactions of a neighboring state; consider storing each state's transactions in separate OUs. This right often exists when the states are independent nations, but seldom when they are federated.

- Use an OU when you need to comply with transaction tax law that is substantially different (more than just the tax rates) to similar laws in neighboring state. You can use product "transaction types" to create similar transactions that follow different documentation and processing practices.

- Use an OU when you wish to keep data of an operation private from management of another operation. For example, within a financial institution division, you may want to keep the transactions and data of the lending operation separate from that of the brokerage operations.

OUs divide the subledger document data in Oracle Financials applications into distinct segments. Standard reports and processes run within OUs; and 'special' reports and processes run across them. You can deploy OUs to provide barriers that require special access, reporting, and processing to cross.

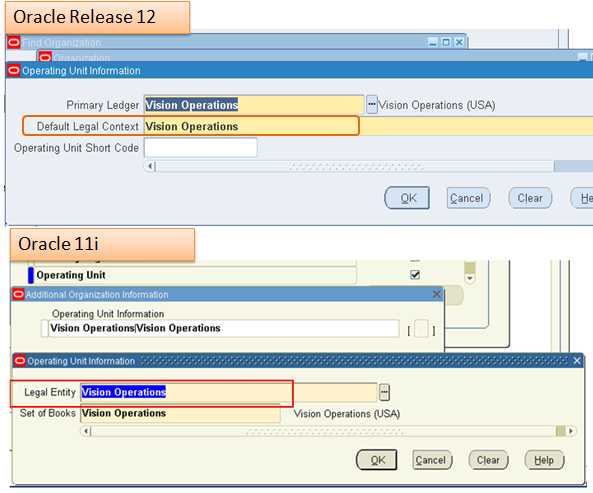

Difference between 11i & R12

In R12 OU is not directly linked with any ledger as it was in 11i where each OU is assigned to a SOB and Legal entity.

In R12 OU is assigned to a Primary Ledger and a default legal context is given to it.

While entering any transaction system tries to find out the legal entity from different defaulting conditions (for example in R12 while entering AR transaction or AP invoice we need to specify the leagl entity which was not the case in 11i), if it does not find any then the dfault legal context LE is considered as the LE for that transaction.

it's good site for know

it's good site for know everything.......